Colorado homeowners often underestimate the length of the foreclosure process. The timeline stretches roughly 230-245 days from your first missed payment. Your loan needs to be delinquent for 120 days before the foreclosure process begins.

The next phase takes another 110-125 days after official filing. You still have rights during this time and can fix your default until 15 days before the scheduled sale. Your chances of keeping your home improve when you know these deadlines and available options.

This piece walks you through each step of Colorado’s foreclosure timeline. You’ll learn what to expect at every stage and understand your rights throughout. The guide also covers different reasons that might make the process longer or shorter.

Understanding the Colorado Foreclosure Process

Overview of the foreclosure process in Colorado

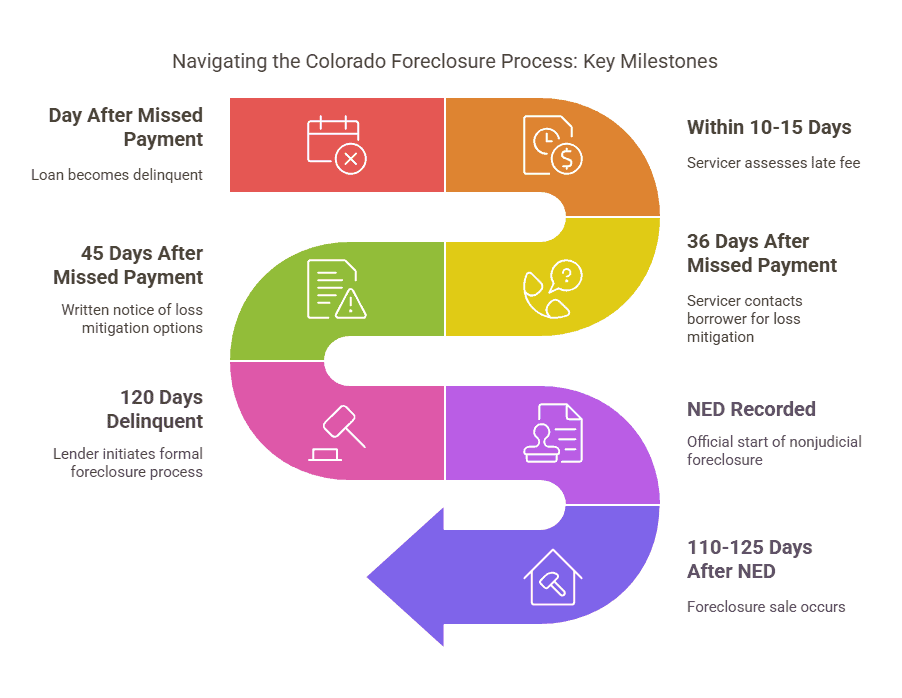

The Colorado foreclosure process is a complex and time-consuming procedure that involves multiple steps and requires compliance with federal and state laws. The process typically begins when a homeowner is 120 days delinquent on their mortgage payments. During this period, the lender will contact the homeowner multiple times regarding missed payments, offering opportunities to discuss loss mitigation options. Once the 120-day delinquency period ends, the lender can initiate the foreclosure process by instructing the Public Trustee to record a Notice of Election and Demand (NED).

The Public Trustee plays a crucial role in the Colorado foreclosure process. After receiving the lender’s instructions, the Public Trustee records the NED, which officially starts the foreclosure process. The NED includes essential details about the loan and the property, and it must be recorded with the county clerk. From the date of recording, the homeowner has 110-125 days before the home is sold at a foreclosure sale. This period allows the homeowner to explore options to cure the default and avoid losing their property.

Importance of knowing the foreclosure timeline

Understanding the foreclosure timeline is crucial for homeowners facing foreclosure. The timeline provides a clear outline of the steps involved in the foreclosure process, including the notice periods, sale dates, and redemption periods. Knowing the timeline can help homeowners make informed decisions about their options and take necessary steps to avoid foreclosure. In Colorado, the foreclosure process can take several months to complete, and homeowners have a unique opportunity known as the “Right to Cure” to bring their mortgage current up to 15 days before the scheduled foreclosure sale.

Being aware of these critical deadlines and rights can significantly impact the outcome for homeowners. By understanding the timeline, homeowners can better navigate the foreclosure process, seek legal advice, and explore alternatives such as loan modifications, forbearance agreements, or even filing for bankruptcy if necessary. Early action and informed decisions are key to protecting one’s home and financial future.

Federal Mortgage Servicing Laws and Colorado Foreclosure Laws

Federal mortgage servicing laws and foreclosure protections

Federal mortgage servicing laws provide essential protections for borrowers throughout the foreclosure process. These laws require servicers to follow specific procedures when a borrower misses a payment. For instance, servicers must contact the borrower by phone to discuss loss mitigation options within 36 days of a missed payment and provide written notice of these options within 45 days. These steps ensure that borrowers are informed about potential solutions to avoid foreclosure.

One of the critical protections under federal law is the prohibition of dual tracking. Dual tracking occurs when a servicer continues to pursue foreclosure while a complete loss mitigation application is pending. This practice is prohibited to ensure that borrowers have a fair chance to explore alternatives to foreclosure without the added pressure of ongoing foreclosure proceedings.

In Colorado, the foreclosure process is governed by state law, and the Public Trustee is responsible for administering the process. The state law requires the lender to provide the borrower with a notice of default and a notice of sale. The borrower has the right to cure the default and reinstate the loan before the sale. These state-specific protections, combined with federal mortgage servicing laws, offer a robust framework to help homeowners navigate the foreclosure process and seek alternatives to losing their homes.

The Pre-Foreclosure Period in Colorado

The pre-foreclosure period is a vital time between your first missed payment and when foreclosure officially begins. A clear understanding of this timeline will help you protect your home.

When does the clock start ticking?

Missing a payment makes your loan delinquent right away, though most mortgages give you a 10-15 day grace period. Your lender will add late fees for each missed payment after this grace period ends. Federal mortgage servicing laws require your loan servicer to reach out within 36 days of your first missed payment to talk about possible solutions. It is crucial to consult a foreclosure attorney early in the process to identify potential defenses and receive guidance on how to avoid foreclosure.

How many missed payments before foreclosure begins

Your mortgage loans must be more than 120 days delinquent before foreclosure can start. Your servicer needs to contact you about loss mitigation options within 36 days of each missed payment during this time. Your servicer must also send written details about available loss mitigation options and assign staff to help you no later than 45 days after a missed payment.

Required notices during pre-foreclosure (30-day notice)

Your lender must send you a specific notice at least 30 days after default and 30 days before filing a Notice of Election and Demand (NED). This notice needs three key elements:

-

-

The Colorado foreclosure hotline phone number

-

A direct line to the lender’s loss mitigation department

-

A statement about illegal foreclosure consultant fees

-

This notice applies to defaults that involve missed payments by the original borrower. The lender keeps the right to foreclose on any other defaults within 12 months once they send this notice.

Your rights during the pre-foreclosure stage

Colorado law gives you strong protections during pre-foreclosure. Your servicer must give you a single point of contact by day 45 of your delinquency. This person becomes your main contact for everything related to foreclosure.

Colorado bans “dual tracking,” which means your lender can’t move forward with foreclosure while they review your application for loss mitigation options. This rule ensures you get a fair chance at alternatives to foreclosure.

Most mortgage contracts include a “breach letter” requirement that lets you fix the default before the lender speeds up the loan. You can also fix the default until 15 days before the scheduled sale date.

Colorado law strictly controls foreclosure consultant services. The Colorado Foreclosure Protection Act stops consultants from taking upfront fees. This law helps protect vulnerable homeowners, especially elderly and financially inexperienced people, from misleading practices.

You keep full ownership rights to your property throughout pre-foreclosure. Only you can allow access, sell, or transfer the property title. Filing for bankruptcy during this time automatically stops all foreclosure proceedings until the court takes further action.

Are you facing foreclosure in Colorado? Don’t navigate this complex process alone. As a Certified Foreclosure Specialist (CFS), I have specialized training and expertise to help you understand your options and potentially save your home. Every day counts in the foreclosure timeline. Contact me today for a confidential consultation to discuss your specific situation and develop a strategic plan forward. Call (720) 730-3730 or email foreclosurehelp @denverrealtyco.com to take the first step toward resolving your foreclosure situation.

Are you facing foreclosure in Colorado? Don’t navigate this complex process alone. As a Certified Foreclosure Specialist (CFS), I have specialized training and expertise to help you understand your options and potentially save your home. Every day counts in the foreclosure timeline. Contact me today for a confidential consultation to discuss your specific situation and develop a strategic plan forward. Call (720) 730-3730 or email foreclosurehelp @denverrealtyco.com to take the first step toward resolving your foreclosure situation.